Telecom Companies to Provide Banking Services to the Customers

However, there were much hype about the shift of the reign of Indian Government from UPA to the one man army, the newly formed Govt. is showing promising moves for the welfare of the citizens. Telecom companies are clearly Modi-fied, as they are to provide basic banking services like bank statement, balance updates via SMS. The companies will engage a share of their infrastructure for providing this service through the user cell phone. A user will be able to get details of fund transfer, mini statement and also will be able to inquire about the account or place cheque book request swiftly via SMS service without having the need to access internet.

How will they provide the service?

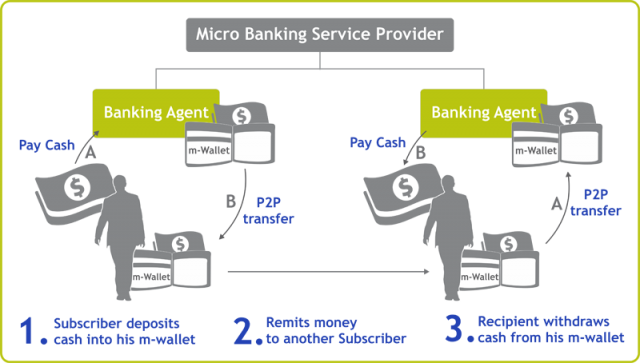

It is reported that already ten leading telecom companies have signed the contract with National Payments Corporation of India (NPCI), the authority of Govt. of India, who scrutinises and maintains the payments gateways. NPCI will use the Unstructured Supplementary Service Data (USSD) structure to provide the service to the users. USSD is basically an interactive messaging service which even allows debit and credit transfer. However, initially the plan is to provide basic banking services such as balance inquiry, mini statement etc.

Expectations and kinks:

The Prime Minister Mr. NarendraModi is likely to announce formally the inauguration of USSD-based banking service this week. But persuading the telecom companies was not easy and has been delayed as the companies was afraid that this service may cause some amounts of loss on the revenue. Initially they were offered with low convenience charge, but with the inclusion of TRAI, the scenario turned towards some positive. According to the last report, each transaction will cost Rs. 1.50. Although this service will use the telecom company’s USSD protocol, but the banks will be responsible for maintaining the quality of service and customer care etc.